Vehicles and homes are typically the most expensive and significant items you can purchase. You may need a vehicle to travel to work and perform other tasks. Your home enables you to invest in an asset that affects your financial stability.

There are multiple factors to consider when you’re thinking about buying a car and a house. Your purchases affect your credit score. Buying either item may make it harder to qualify for another loan. As a result, you may be wondering if it’s better to buy a car or a house first. Let’s explore some factors you should consider to determine how you should proceed.

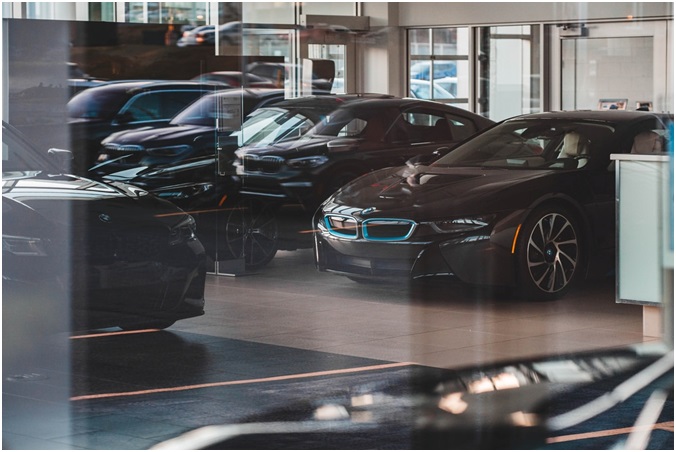

Should you buy a house before purchasing a car?

When the U.S. housing marketplace is thriving, it can be challenging to buy a home. Buyers might find themselves competing against other buyers. Multiple bids can cause home prices to increase, making it harder to buy a house. For example, Chase Bank wants homeowners to spend 28 percent of their income or less on their mortgage, which is why your income affects how much money you can borrow. A larger down payment can increase the amount you can spend on a house, but you’ll need to save funds to increase your down payment, which is why you may want to buy a house before buying a car.

After purchasing a home, you can protect yourself financially by finding one of the best home warranty companies in Texas and taking out an account. Home warranty companies cover the costs of repairs. Suppose your dishwasher or refrigerator stops working. Your home warranty company will send a technician to inspect the appliance and determine whether your plan covers the repairs. They’ll order the parts required and make necessary repairs. Home warranty plans prevent you from struggling to come up with the funds to deal with emergency repairs.

Should you buy a car before buying a house?

Online auctions enable you to choose from vehicles for sale throughout the United States. Prospective buyers review the vehicles, confirm the auction schedule for vehicles they’re considering, and make online bids. It’s also possible to purchase the vehicle outright without waiting for the car auction. Auto auction companies offer direct financing, making it easy to apply for the financing required. Online auctions provide critical vehicle information, including the vehicle identification number (VIN), enabling you to verify the manufacturer and vehicle specifications. You can also use the VIN to check the vehicle’s history, ensuring your peace of mind because you can confirm the vehicle doesn’t have active liens against its title. Whether you’re shopping for an SUV, a truck, or a car, you can use online auctions to the types of vehicles suitable for your needs.

How do lenders decide which loans to approve?

Moneylenders include banks and credit unions. There are also private groups that offer loans, including hard money loans. Moneylenders try to determine the likelihood borrowers will repay the loan.

Financial institutions use a formula to determine how much disposable income applicants have before deciding on loan applications. They also review the applicant’s credit history to determine if they have a track record of paying off debts or defaulting on loans. Lenders also expect the applicant’s total monthly bills not to exceed 35 percent of their income. Consequently, significant bills, such as student loans or car payments, may prevent you from affording a mortgage.

However, purchasing a vehicle may strengthen your mortgage application if you make consistent payments for several months before you try to buy a home. Making regular payments increases your credit score. However, you must ensure you buy an affordable vehicle and keep your car payments low enough to afford to buy a house.

Cars and homes are expensive. Reviewing your financial situation and your current expenses can help you determine whether to purchase a car or a home first.